In a major boost for global markets, the U.S. and China have agreed to temporarily reduce tariffs after successful trade talks held in Switzerland over the weekend. The announcement sparked a global rally in stocks and renewed confidence among investors.

Key Highlights:

- Tariffs cut from over 100% to 10% for 90 days on both sides.

- 20% tariffs on fentanyl-related imports from China will remain.

- Stocks in Asia, Europe, and the U.S. jumped after the news.

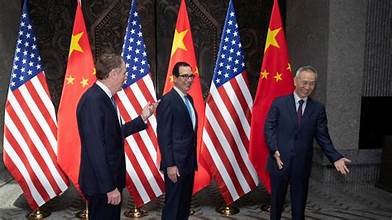

U.S. Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer shared the news in Geneva, calling it “substantial progress” toward ending the long-running tariff war.

Markets React Positively

Global markets responded immediately.

- Europe’s Stoxx 600 gained nearly 1%.

- Germany’s DAX hit a 1-year high.

- Hong Kong stocks soared 3%.

- On Wall Street, Nasdaq futures rose 3.8%, S&P 500 futures were up 2.8%, and Dow Jones gained 3.1%.

Analysts See a Turning Point

Experts are calling the deal a “dream scenario” for investors.

Tai Hui of JPMorgan Asset Management said the size of the tariff cut was larger than expected. However, he warned that 90 days might not be enough time to finalize a full trade deal.

“The deal keeps pressure on both sides to negotiate,” said Hui. “Markets are likely to remain optimistic in the short term.”

Jordan Rochester of Mizuho Bank noted that the effective tariff rate will fall from 108.8% to 27%, far better than the expected range of 50-60%.

“This changes the global trade outlook and may lead to similar deals with other countries,” Rochester said.

U.S. Assets Gain Strength

- The U.S. dollar index rose 1%.

- 10-year Treasury yields went up by 6 basis points.

This signals a shift in market sentiment and a move away from the recent “Sell America” trend seen after earlier tariff announcements.

Tech and Trade to Benefit Most

Emmanuel Cau of Barclays said there’s still room for U.S. stocks to climb higher, especially for exporters and sectors hit hardest by the trade war.

Deutsche Bank strategists said U.S. equities could now outperform European stocks in the short term.

“This is a clear signal to stay bullish,” they advised.

Sydbank’s Mikkel Emil Jensen called the agreement a “major de-escalation” of trade tensions. He expects shipping demand to rise as trade activity resumes, noting Maersk shares surged over 12% following the announcement.

Looking Ahead

Dan Ives of Wedbush Securities said this is just the start of broader negotiations, and expects further tariff reductions in the coming months.

“We now see new highs for tech stocks and the overall market in 2025,” Ives added.

While the deal is only temporary, it is expected to restart global trade, boost freight shipments, and encourage companies to rebuild inventories.

Lindsay James of Quilter noted that while the new tariff level is not as low as it was before, it will still allow a large portion of trade to resume—even if prices remain slightly elevated.