Uncertainty Undermining U.S. Business Confidence

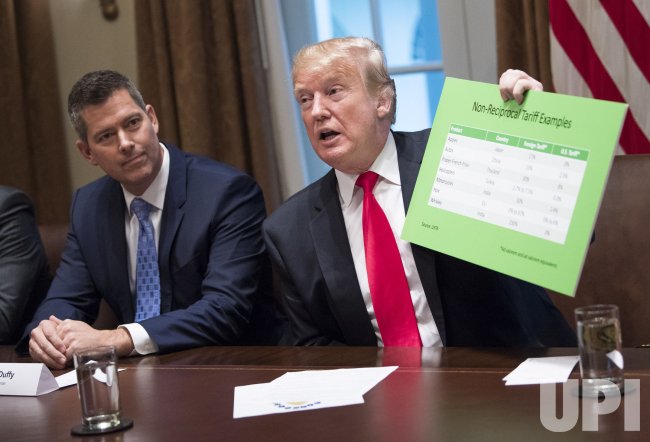

While Donald Trump continues to promote large-scale corporate investments as proof of his economic strategy’s success, his unpredictable trade policies may actually be creating a climate of fear and hesitation among American businesses.

In today’s global economy, business leaders demand clarity and long-term stability before committing billions to infrastructure, factory development, or job expansion. But under the current administration’s volatile trade tactics, such confidence is quickly eroding.

CEOs Facing Economic Instability

America’s top executives are grappling with one of the most uncertain economic environments in recent history. As markets fluctuate based on rumors and abrupt policy announcements, trade war concerns have reached critical levels.

“Without question, this level of unpredictability is freezing investment,” says John Graham, finance professor at Duke University. CEOs are reluctant to move forward when the rules of international trade shift without warning.

Historical Parallels: Lessons from the Great Depression

Former Federal Reserve Bank of St. Louis President James Bullard warns that Trump’s tariff approach could echo the infamous Smoot-Hawley Tariff Act of 1930, which deepened the Great Depression by triggering global retaliation and slashing U.S. imports by 40% in just two years.

“Why would companies invest when they don’t know what tomorrow’s regulations will look like?” Bullard asked.

Tariff Turmoil Is Halting Business Growth

Mary Lovely, senior fellow at the Peterson Institute for International Economics, notes that many firms are unable to move forward with investments due to the unknown longevity of tariffs. She emphasized, “The level of economic uncertainty right now is unprecedented.”

Even high-profile Trump allies, like hedge fund billionaire Bill Ackman, have criticized the administration’s global tariff approach. Although he supports fair trade, Ackman warns that this broad economic conflict could be devastating to American business confidence and foreign investment.

Companies Caught in a Planning Deadlock

Firms are struggling to assess costs and plan production because they don’t know whether tariffs on imports from China and Mexico will be 0% or jump to 50%. With the threat of retaliatory tariffs from international partners, U.S. companies can’t predict future demand or pricing.

Stock Market Shockwaves Reflect Deeper Worries

While Wall Street is often separated from Main Street, the two are undoubtedly connected. The ongoing trade tensions have caused major market dips, reflecting investor unease about future economic performance.

“When the markets fall,” Ackman points out, “consumer spending stops, investments freeze, and layoffs follow.” The market’s volatility is not just a reaction — it’s a warning signal.

Oil Industry Joins the Chorus of Concern

Even the traditionally supportive energy sector is sounding alarms. One oil executive, speaking to the Dallas Fed, described Trump’s chaotic trade policy as “a disaster for commodity markets.” Promises of American energy dominance now seem undermined by Washington’s policy confusion.

“Drill, baby, drill” has become nothing more than a populist slogan, they said, highlighting how inconsistent tariffs make it impossible to plan operations or forecast profits.

Conclusion: Chaos Is Not a Strategy

With economic uncertainty peaking, even Trump’s strongest supporters are urging a course correction. The lack of strategic direction in tariff policies is discouraging investment, destabilizing markets, and potentially pushing the U.S. toward a recession.

To regain momentum, businesses need clear trade policies, stable markets, and a predictable regulatory environment — not more economic chaos.